A track record of sound stewardship.

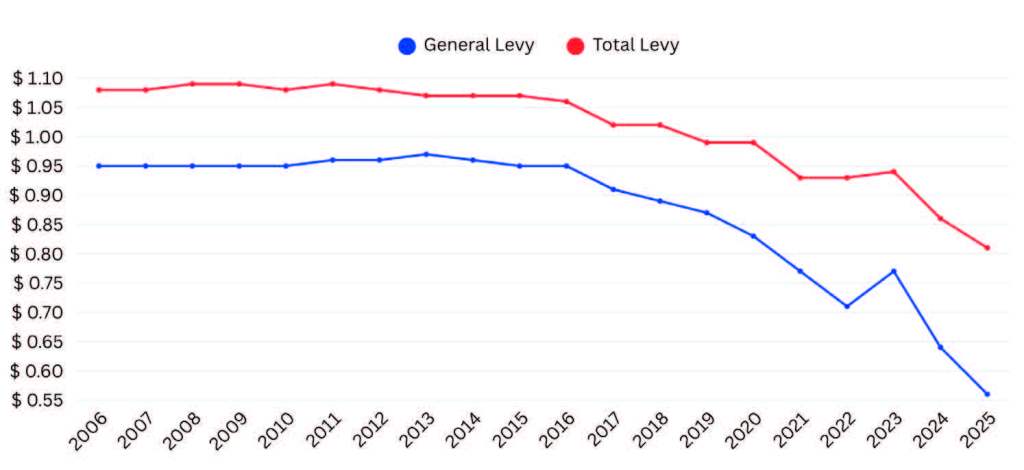

It’s no exaggeration to say that Ashland-Greenwood has established a clear pattern of fiscal responsibility and frugality with taxpayer money. AG’s levy has been historically quite low compared to neighboring districts and schools across the state.

Our school board has worked for years to maintain the lowest possible burden on taxpayers. The 3% revenue cap imposed by the Nebraska legislature penalizes districts like ours that have budgeted prudently.

Now we ask voters to extend that same conscientious stewardship to AGPS by voting FOR exceeding the 3% cap on our general fund—a vote that will modestly impact property taxes while keeping our schools strong.

Estimated Tax Impact

Residential Estimated Tax Impact

| Monthly | Annually | |

| $150,000 | $10 | $120 |

| $250,000 | $17 | $200 |

| $500,000 | $33 | $400 |

Ag Land Value (Dry) Estimated Tax Impact

| Monthly | Annually | |

| $250,000 | $12.50 | $150 |

| $500,000 | $25.00 | $300 |

| $750,000 | $37.50 | $450 |

Please Consider!

- If the vote passes, the new levy will not affect 2025 crop returns.

- Do you qualify for the Homestead Exemption Act? Your exemption will apply to any override on the 3% cap.

- If valuations contine to increase over time, your individual tax burden will likely decrease as a result.